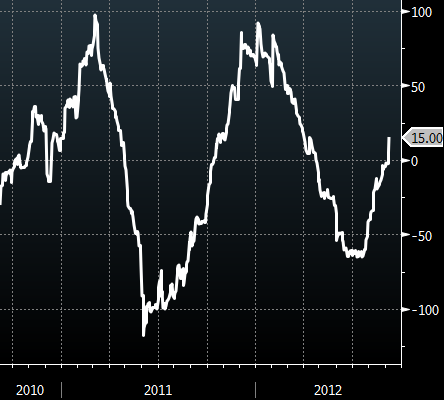

The UK economy is in a "double dip" recession, with the longest recovery in recent history - and still nowhere close to the pre-recession GDP. The nation was impacted by the US financial crisis as hard as it was hit by the Eurozone contraction.

|

| Source: DB |

Somewhat surprisingly however, the UK's overall workforce rebounded this year.

|

| UK Employment Workforce Jobs By Industry All Jobs (unit = 1000, Bloomberg) |

More workers and low GDP means that the output per worker (productivity) has worsened dramatically.

DB: - ... output per person or per hour worked – has been exceptionally weak in this recession. In fact, depending on exactly how we measure it, UK workers are 2-3% less productive than before the crisis five years ago. In the absence of a crisis, we would have expected to be well over 10% more productive than five years ago. In terms of the sectors that have been responsible for this weakness, it has been services rather than manufacturing, but also the extraction sector (North Sea oil/gas extraction and production) where we’ve seen productivity slide the most.DB proposes multiple explanations for the UK's relatively poor productivity, including declining wages (that allow companies to keep more workers), public jobs, and fewer bankruptcies than in previous recessions. None seem to provide the full answer. A more troubling explanation however is that the UK unemployment is simply lagging the GDP decline and we will see more layoffs going forward. The reduction in the number of employees in turn will improve labor productivity as it did in the US where companies were quick to let employees go.

SoberLook.com